Brand analyst report for automotive suspension and brake pads. Example

Analytics developed by order of a leading manufacturer of suspension elements, supplier of automotive conveyors (OEM).

1. The number of products in the report.

| Product group | Number of articles SKU | Participate in the comparison | IAM- number of competing products | Unique Brand offers: no competitors Brand has | Deficiency: There are competitors NO to Brand Distributors | There is no data: NO competitors NO to Brand Distributors |

| brake pads | *** | *** | *** | *** | *** | *** |

| steering tip | *** | *** | *** | *** | *** | *** |

| stabilizer, traction, rack | *** | *** | *** | *** | *** | *** |

| center link | *** | *** | *** | *** | *** | *** |

| Lever arm | *** | *** | *** | *** | *** | *** |

| ball joint | *** | *** | *** | *** | *** | *** |

| silent blocks | *** | *** | *** | *** | *** | *** |

| stabilizer bush | *** | *** | *** | *** | *** | *** |

| pendulum arm | *** | *** | *** | *** | *** | *** |

| shock absorber support | *** | *** | *** | *** | *** | *** |

| pitman arm | *** | *** | *** | *** | *** | *** |

| engine mount, gearbox | *** | *** | *** | *** | *** | *** |

| clamp, mount | *** | *** | *** | *** | *** | *** |

| spring spacer | *** | *** | *** | *** | *** | *** |

| All goods |

You can order a detailed analytical report and research of the auto components market at:

We work with big data, use statistic analysis, find complex dependencies, build mathematical models. We know how to work with highly noisy material. Describe your task, we will discuss!

2. Price (RUB) b2b market summary. The average market price is calculated based on IAM offers. In the table (and further), we calculate the average price only for competing positions (Brand and competitors have it).

| Product group | Number of articles Brand | Participate in the comparison | IAM- number of competing products | Qty art. The price of Brand is cheaper than the market 5% <- | Qty. Art. Brd Price equal to the market +/- 5% | Qty. Art. Brand Price more expensive than the market -> 5% | Average price of Brand | Average price of the market (competitors) | Deviation from the market. Brandmore expensive + ..% or cheaper - ...% |

| brake pads | *** | *** | *** | *** | *** | *** | *** | *** | *** |

| steering tip | *** | *** | *** | *** | *** | *** | *** | *** | *** |

| stabilizer, traction, rack | *** | *** | *** | *** | *** | *** | *** | *** | *** |

| center link | *** | *** | *** | *** | *** | *** | *** | *** | *** |

| lever arm | *** | *** | *** | *** | *** | *** | *** | *** | *** |

| ball joint | *** | *** | *** | *** | *** | *** | *** | *** | *** |

| silent blocks | *** | *** | *** | *** | *** | *** | *** | *** | *** |

| stabilizer bush | *** | *** | *** | *** | *** | *** | *** | *** | *** |

| pendulum arm | *** | *** | *** | *** | *** | *** | *** | *** | *** |

| shock absorber support | *** | *** | *** | *** | *** | *** | *** | *** | *** |

| pitman arm | *** | *** | *** | *** | *** | *** | *** | *** | *** |

| engine mount, gearbox | *** | *** | *** | *** | *** | *** | *** | *** | *** |

| clamp, mount | *** | *** | *** | *** | *** | *** | *** | *** | *** |

| spring spacer | *** | *** | *** | *** | *** | *** | *** | *** | *** |

| All goods | *** | *** | *** | *** | *** | *** | *** | *** | *** |

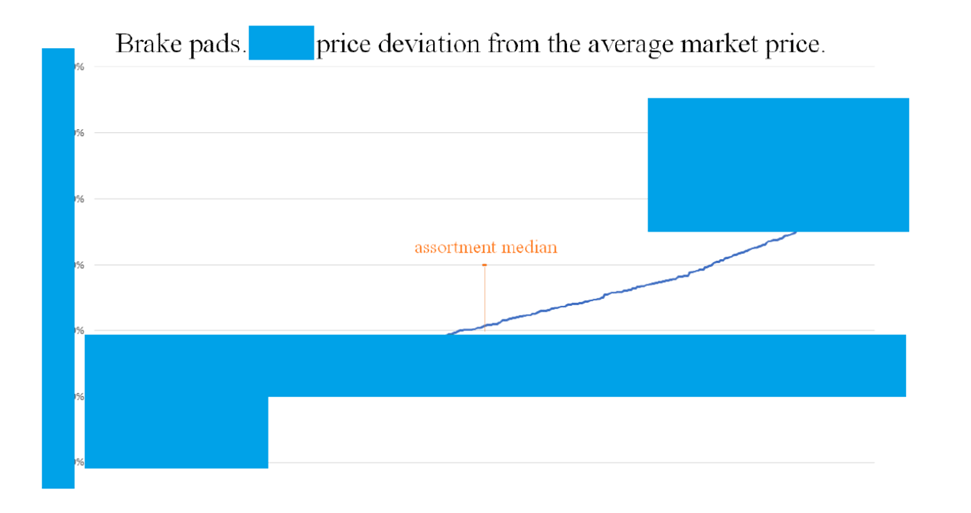

Important! Despite the fact that the average Brand price for the entire assortment is - 4% cheaper than competitors, the number of «expensive» items (1718) exceeds the number of «cheap» ones (1490). This means that the price is not evenly distributed. Products in the high price segment of Brand are cheaper than competitors. However, the number of units of expensive goods is greater. For example, this is clearly seen in the graph of the brake shoe price distribution.

We can create an assortment development model for your brand in the Russian spare parts market taking into account geography and competitors using the most modern machine learning methods (AI) and Big Data technology.

3. Brake pads. Brand price deviation from the average market price. The horizontal axis is the item number of the Brand assortment. The vertical axis is the deviation of the Brand price from the market. If the chart is in the negative zone, the Brand price is cheaper. Chart in the positive zone – Brand price is more expensive. The number of «cheap» positions 236; «Price equal to the market +/- 5%» 103; «expensive» 272.

Statistics of the Automotive and Aftermarket of Russia. Segments: car brands, regions, brands, product groups, OE - numbers, analogues, wholesale and retail prices.

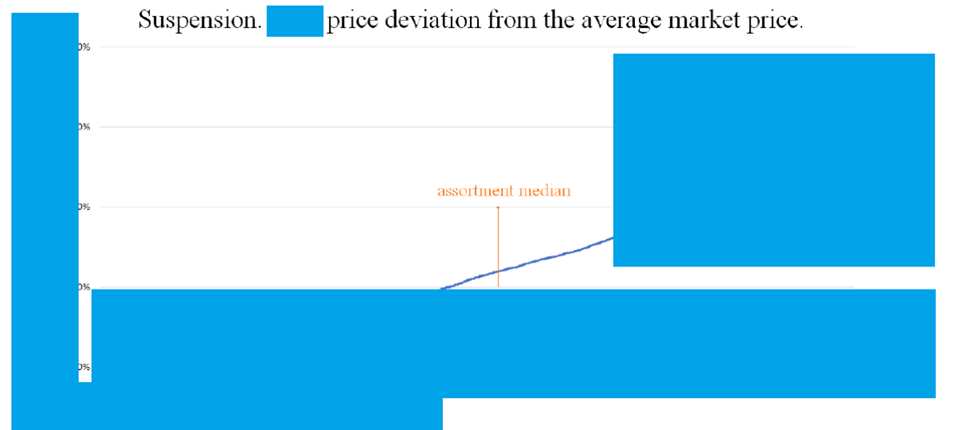

4. Suspension (all). Brand price deviation from the average market price. The horizontal axis is the item number of the Brand assortment. The vertical axis is the deviation of the Brand price from the market. If the chart is in the negative zone, the Brand price is cheaper. Chart in the positive zone – Brand price is more expensive. The number of «cheap» 1254; «Price equal to the market +/- 5%» 498; «expensive» 1446.

We have been working in the market of auto parts for foreign cars for 20 years. We know the segments: retail, car service, b2b distributors, conveyor supplies.

5. The main competitors for the price. The number of competitors with the lowest price.

| Product group | Qty. Brd in comparison | JUST DRIVE (JD) | SAT | STELLOX | PATRON | GMB | NIPPARTS | 555 | FEBEST | 4U | LYNX | CAR-DEX | GSP | ONNURI | DELTA | PARTS-MALL | AKITAKA | BAW | KASHIYAMA | JAPANPARTS | MILES | FENOX | JEENICE | AMD | HSB | SANGSIN | BRAMAX | DODA |

| brake pads | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** |

| steering tip | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** |

| stabilizer, traction, stand | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** |

| center link | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** |

| lever arm | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** |

| ball bearing | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** |

| silent block | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** |

| stabilizer bush | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** |

| swingarm | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** |

| shock absorber support | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** |

| engine mount, gearbox | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** |

| pitman arm | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** |

| Total positions | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** | *** |

Do you need to formulate a strategy for bringing a brand to the auto parts market? Need digital marketing consulting? Write to us:

6. The structure of the range of Brand by auto brands.

7. The main report. The report table contains Brand articles from the “suspension” and “brake pads” assortment with decoding of product groups, linking to makes and models of cars, articles of competitors IAM and OE. The minimum-average-maximum price of the b2b market is given (the price from the distributor to the store or service station), and the prices of competitors in detail. The following tables are highlighted products:

- Unique Brand Offers. The product is on the market, no competitors' offers were found. It can be both truly unique products (competitive advantage), and products with poor cross-linking of articles (in fact, there are analogues, but there are no crosses).

- Deficit. There are no Brand products in distributors' offers, but there are analogues of competitors. A question for study with distributor purchasers.

- There is no data. Brand distributors do not have these products, and competitors do not have any offers. However, among them there are 60 positions for which there are OE numbers and prices. Most likely, the goods are not in stock due to low liquidity (a small fleet of vehicles). Or, no analogues have been found due to poor article cross-linking.

Upon analysis of the main report, based on your needs, we can rearrange the data, add additional filters to brands / models of cars, enter a competitor rating to calculate the reference price for the market.

We will be grateful for the feedback.

Aftermarket-DATA © - market analytics for manufacturers and distributors of auto parts

Уникальные аналитические обзоры, эксклюзивные инсайты и прогнозы в нашем Tg-канале

Уникальные аналитические обзоры, эксклюзивные инсайты и прогнозы в нашем Tg-канале